Urban renewal calls for diversified funding sources

A diversified funding mechanism is needed to support China's accelerating urban renewal efforts, as such projects typically involve sizable investments and extended timelines, with government financing and private investment working in tandem, experts have said.

By the end of 2024, China's urbanization rate reached 67 percent, with 943.5 million people living in urban areas, according to data from the National Bureau of Statistics.

"This has prompted a shift in China's urban development strategy, with a greater emphasis on revitalizing existing facilities rather than large-scale expansion," said Yang Baojun, president of the Urban Planning Society of China.

Whether it's the renovation and upgrading of aging buildings, the optimization of infrastructure, or the enhancement of public spaces, urban renewal requires substantial financial resources, Yang added.

"Overcoming the funding hurdles of urban renewal will require the concerted efforts of all stakeholders — the government, private sector, and the public," Yang said.

In its latest push to tackle these issues, China issued a guideline in May pledging increased policy and financial support for urban renewal projects, which range from gas pipeline upgrades and elevator installations to the renovation of old factories into commercial zones.

China renovated 280,000 aging residential communities from 2019 to 2024, benefiting more than 120 million people, data from the Ministry of Housing and Urban-Rural Development showed.

Government-led funding remains foundational for large-scale urban renewal projects, which often require trillion-yuan investments and decade-long timelines, said Tang Yan, a professor specializing in urban design and planning at Tsinghua University.

"The government can also facilitate urban renewal by offering tax and fee incentives, such as reductions or exemptions on taxes, administrative charges, and land transfer fees," Tang added.

China Development Bank has channeled 575.1 billion yuan ($80 billion) in loans to the urban renewal sector in the first five months of this year.

Shao Tianxia, a customer manager at the bank's Jiangxi provincial branch, said the lender provided a long-term loan of around 10 million yuan for the renovation project of the Fuli residential community in Pingxiang, Jiangxi, guided by a market-oriented approach.

"The one-time investment required for the renovation of aging urban communities is typically substantial, while the payback period is relatively long," Shao said. "The key is to design a financing scheme that can help the project achieve a profitable model."

After the renovation, the community's environment has become cleaner and more aesthetically pleasing. To sustain these improvements, the community has implemented a unified property management system, with property fees and parking charges serving as revenue streams for the project.

Furthermore, the project developers have the rights to operate nearby agricultural markets, which are expected to see increased foot traffic and vendor activity as the community's transformation progresses.

"As the surrounding markets become more vibrant, the related operating income will gradually increase, providing stronger cash flow assurance for loan repayment," Shao said.

The sheer scale of investment required for urban renewal far exceeds what the government can provide, especially in regions that are already grappling with debt burdens and trying to mitigate financial risks, experts said, underscoring the critical need to mobilize more private capital to complement the government's funding efforts.

However, the inherent characteristics of these projects — their strong public-good nature, large investment scales, long payback periods and low returns — have dampened the appeal for private capital, said Wang Binwu, an associate researcher of the policy research center at the Ministry of Housing and Urban-Rural Development.

To attract greater private sector participation in these capital-intensive projects, policymakers are exploring new initiatives, including leveraging new government-social capital cooperation mechanisms and real estate investment trusts in the infrastructure sector — areas that offer moderate returns and pique the investment interest of social capital, Wang said.

Banks and other financial institutions are tailoring their product offerings, loan amounts, tenors, interest rates and repayment structures to align with the specific needs of urban renewal projects, Wang added.

Today's Top News

- Green, beautiful, liveable cities call for modernized urbanization path: China Daily editorial

- Urban renewal beyond economic growth

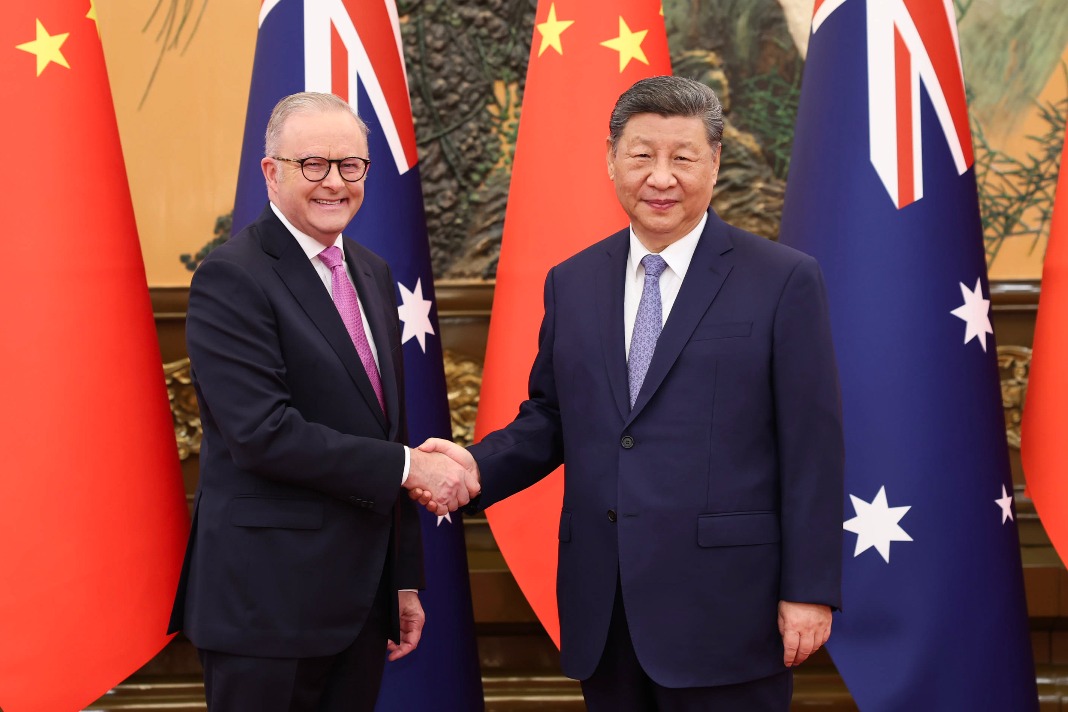

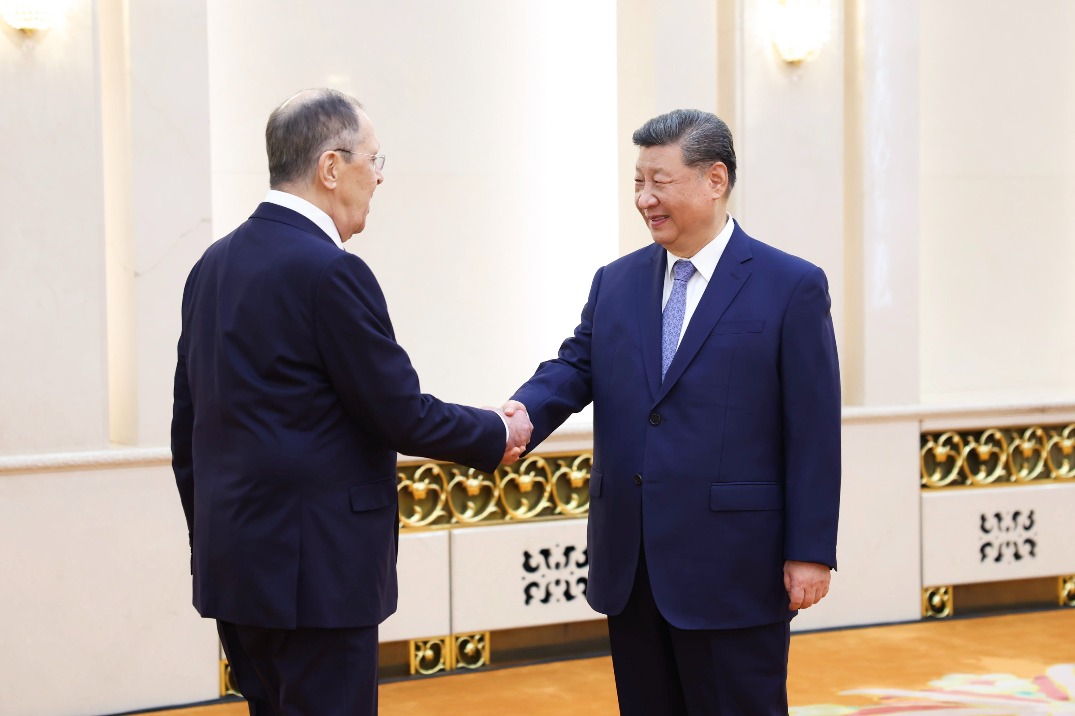

- Xi meets Russian FM in Beijing

- Xi meets heads of foreign delegations attending SCO council of foreign ministers meeting

- Xi addresses Central Urban Work Conference, listing priorities for urban development

- China reports 5.3% GDP growth in H1