Instant retail sector heating up

On-demand deliveries fitting in nicely with national plan to boost consumption

Competition in China's instant retail sector is heating up as major players are banking on the fast-growing food delivery modality to cater to consumers' rising demand for speedy and affordable on-demand delivery services, and to seek new sources of revenue, industry experts said.

They said that supply chain capabilities, fulfillment efficiency and service quality will be the key factors that determine the future landscape in the instant retail market, while platforms should ramp up technological innovation, optimize delivery networks and adopt differentiated strategies to further improve user experience.

Instant retail refers to a model where shoppers place orders via online trading platforms, after which retailers from brick-and-mortar stores execute door-to-door deliveries themselves or through third-party delivery platforms. The model is regarded as an important strategic battlefield for e-retailers, with on-demand deliveries usually requiring 30 to 60 minutes to be completed.

Alibaba Group's Taobao Instant Commerce and Ele.me — its food delivery subsidiary — announced on Monday that the number of daily orders has surpassed 80 million, with daily active users from its on-demand delivery business reaching more than 200 million. The number of newly registered merchants has surpassed 240,000.

Alibaba's instant delivery service, which was officially launched in early May, has expanded across the nation, offering rapid deliveries for various goods beyond foodstuffs — such as electronics, clothing and flowers — within an hour. The orders are fulfilled by Ele.me.

The figures were released after food delivery platform Meituan said its daily order volume covering food and retail goods amounted to 150 million on Saturday, hitting a record high, and the average delivery time is 34 minutes.

Daily transaction volumes on these platforms have seen rapid growth as major players started to offer more discounts and subsidies to boost consumption. Taobao Instant Commerce has launched a substantial subsidy program worth 50 billion yuan ($7 billion) over the next 12 months for both consumers and merchants, while Meituan issued huge discounts and purchase coupons to attract more consumers.

Moreover, Chinese e-commerce giant JD has entered into the highly competitive food delivery sector, providing comprehensive support like low or zero commission fees to catering merchants who register on its platform, and stepping up the recruitment of full-time delivery riders.

According to a report from the Chinese Academy of International Trade and Economic Cooperation, the market scale of China's instant retail sector reached 650 billion yuan in 2023, up 28.89 percent year-on-year. The figure is expected to surpass 2 trillion yuan in 2030.

Chen Liteng, senior analyst at the Internet Economy Institute, a domestic consultancy, said the discounts and subsidies provided by platforms have effectively stimulated users' consumption appetites and boosted the explosive growth of the instant retail market given that boosting consumption is a top priority for the country's economic growth for this year.

"The sharp increase in order volumes demonstrates the growing consumer demand for personalized instant services, creating significant commercial value for platforms," Chen said. However, these platforms are still facing some challenges such as fulfillment efficiency and shortage of delivery riders.

Guo Tao, deputy head of the China Electronic Commerce Expert Service Center, said competition in the instant retail sector is not concentrated on a mere price basis, but has transitioned toward supply chain capabilities, instant delivery efficiency and user experience.

Noting that steep discounts and subsidies cannot continue for extended periods, Guo said the platforms should provide differentiated products and elevate service quality such as stable fulfillment and after-sales guarantees to enhance customer retention, while expanding the scope of service scenarios, increasing product categories and improving their cost-effectiveness.

"Instant retail is regarded as an important development direction for the future retail sector as enterprises can leverage their existing logistics and supply chain advantages to explore new growth points," said Hong Yong, an associate research fellow at the Chinese Academy of International Trade and Economic Cooperation.

Hong said competition in the on-demand retail market is becoming increasingly fierce, with major players including e-commerce platforms, local life service enterprises and traditional retailers upping the ante in the sector, adding that the key to success will focus on the optimization of the user experience, expansion of service scope and supply chain efficiency.

Today's Top News

- Green, beautiful, liveable cities call for modernized urbanization path: China Daily editorial

- Urban renewal beyond economic growth

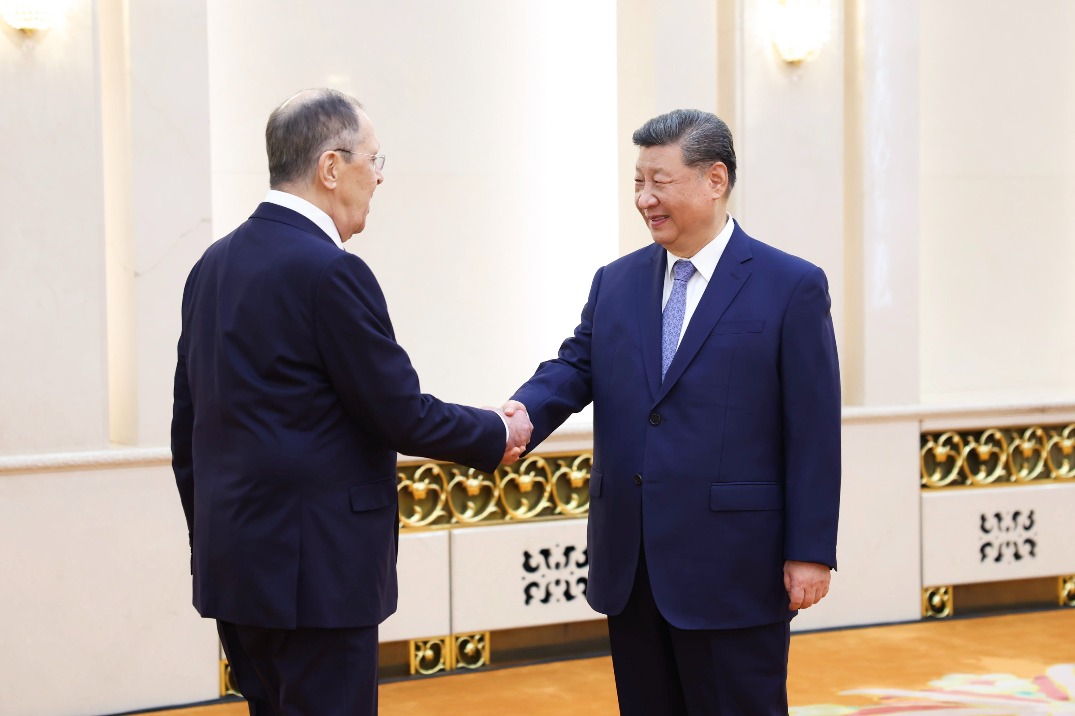

- Xi meets Russian FM in Beijing

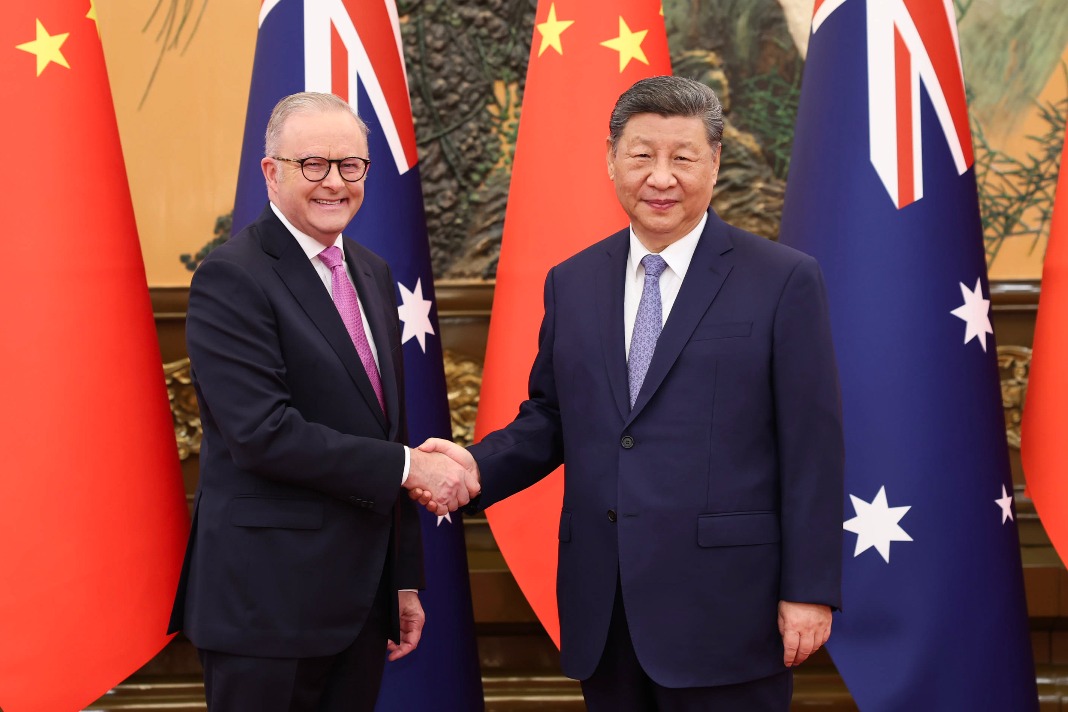

- Xi meets heads of foreign delegations attending SCO council of foreign ministers meeting

- Xi addresses Central Urban Work Conference, listing priorities for urban development

- China reports 5.3% GDP growth in H1